Autumn 2024

Amy Morris

Managing Director – UK & Europe

Reviewing the external HR jobs market, we are encouraged that the HR, reward, and payroll sectors displayed steady growth in the first half of the 2024 financial year, with a 5% increase in external HR, reward and payroll job listings from Q1 to Q2, indicating a stable yet growing landscape in HR.

Key Job Function Trends

(Data source: Vacancysoft)

Rising Demand in Talent Acquisition

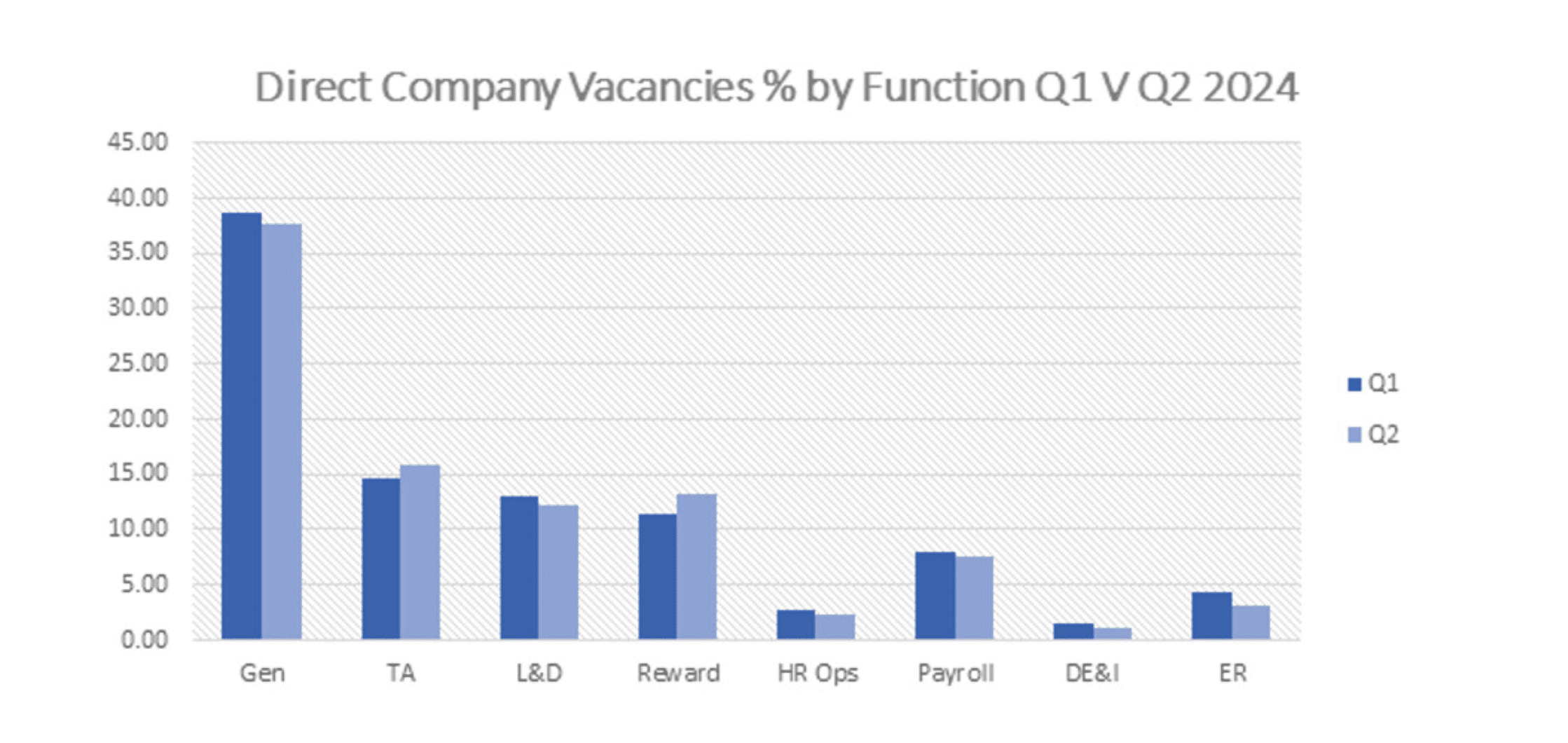

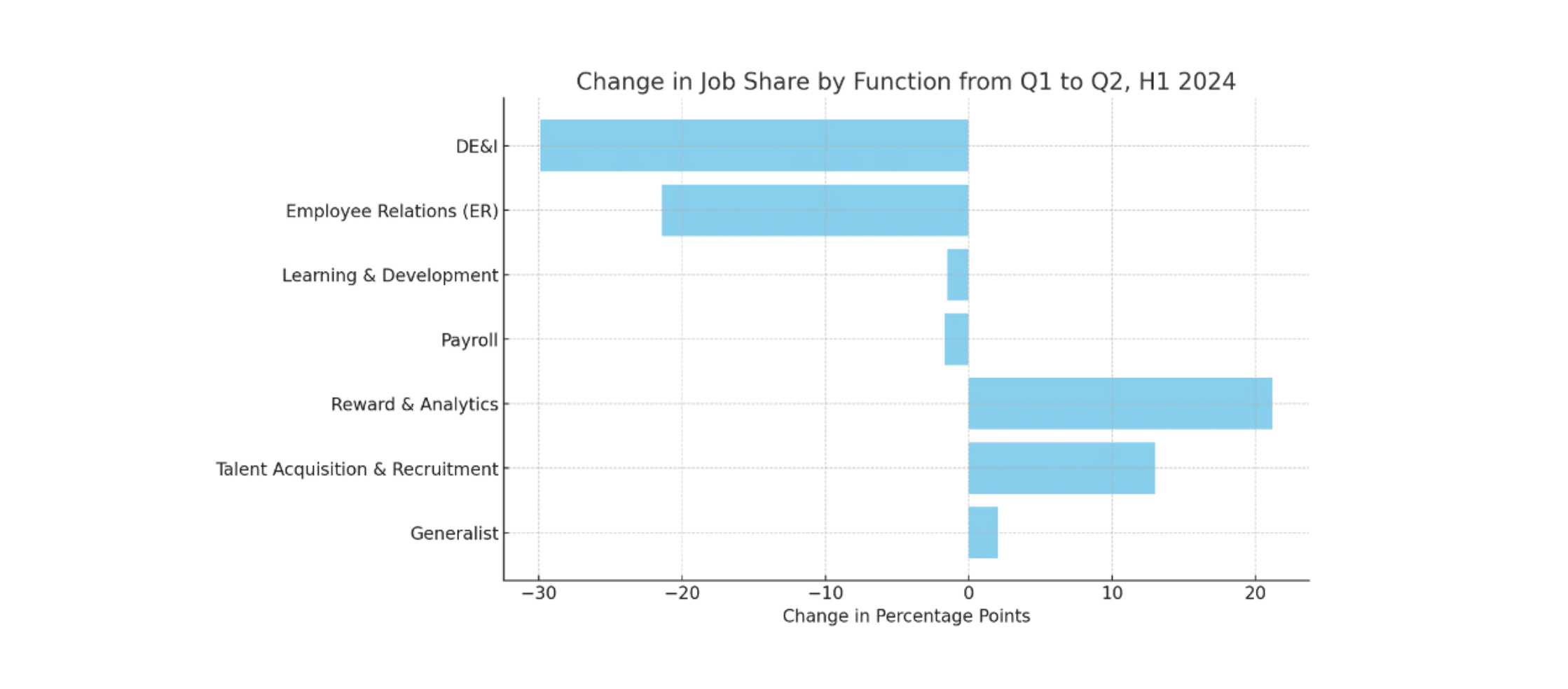

The most significant growth within the HR sector saw talent acquisition and recruitment roles increase 13% from Q1 to Q2, making up 15.3% of all HR positions. These numbers suggest companies are preparing for a competitive hiring landscape by strengthening recruitment efforts to secure top talent.

Continuing Demand for HR Generalists

HR generalist roles remain the most prevalent, comprising 38.1% of HR job listings and growing by 2% from Q1 to Q2. This stability highlights the ongoing need for versatile HR professionals who can handle a range of responsibilities and adapt to evolving commercial and organisational needs.

Reward and Analytics Functions Surge

first six months of this financial year, now accounting for 12.2% of all HR positions. As economic pressures have increased and the impact of the EU Pay Transparency Directive looms large, this trend emphasises a continued market shift toward leveraging data-driven compensation strategies aimed at enhancing employee retention and satisfaction.

In their August 2024 market insight, our Reward & Analytics team highlighted an “increase in permanent roles for data and system experts” with in-demand skills including configuration, building dashboards and compensation modules and data analytics.

Consistent Demand for Payroll Specialists

Payroll roles held relatively steady at 7.7% of the HR job market, with a minor decrease of 1.7% from Q1 to Q2. Despite this marginal decline, the demand for payroll professionals remains robust. This reflects their essential role in maintaining operational continuity, despite slight fluctuations while companies rely on specialist payroll functions to manage increasingly complex compensation systems and navigate legislative changes.

Oakleaf’s specialist payroll recruitment division noted that “payroll is becoming data-driven, utlilising systems and technology for compliance, reporting and analytics.”

Mixed Signals in Learning & Development

While demand for L&D roles declined overall, more recent growth has been reported, underscoring the value of specialized learning and development initiatives to support internal growth, adaptability and engagement in a fluctuating financial environment.

Decline in ER and DE&I Roles

Surprisingly, demand for ER and Diversity, Equity, and Inclusion (DE&I) roles fell sharply by 21.4% and 29.9%, respectively. This may reflect consolidation of these specialisms into broader roles in companies with budget constraints, though expanding DE&I focus remains critical for organisations to maintain a positive culture.

Year-on-Year Growth in HR Functions

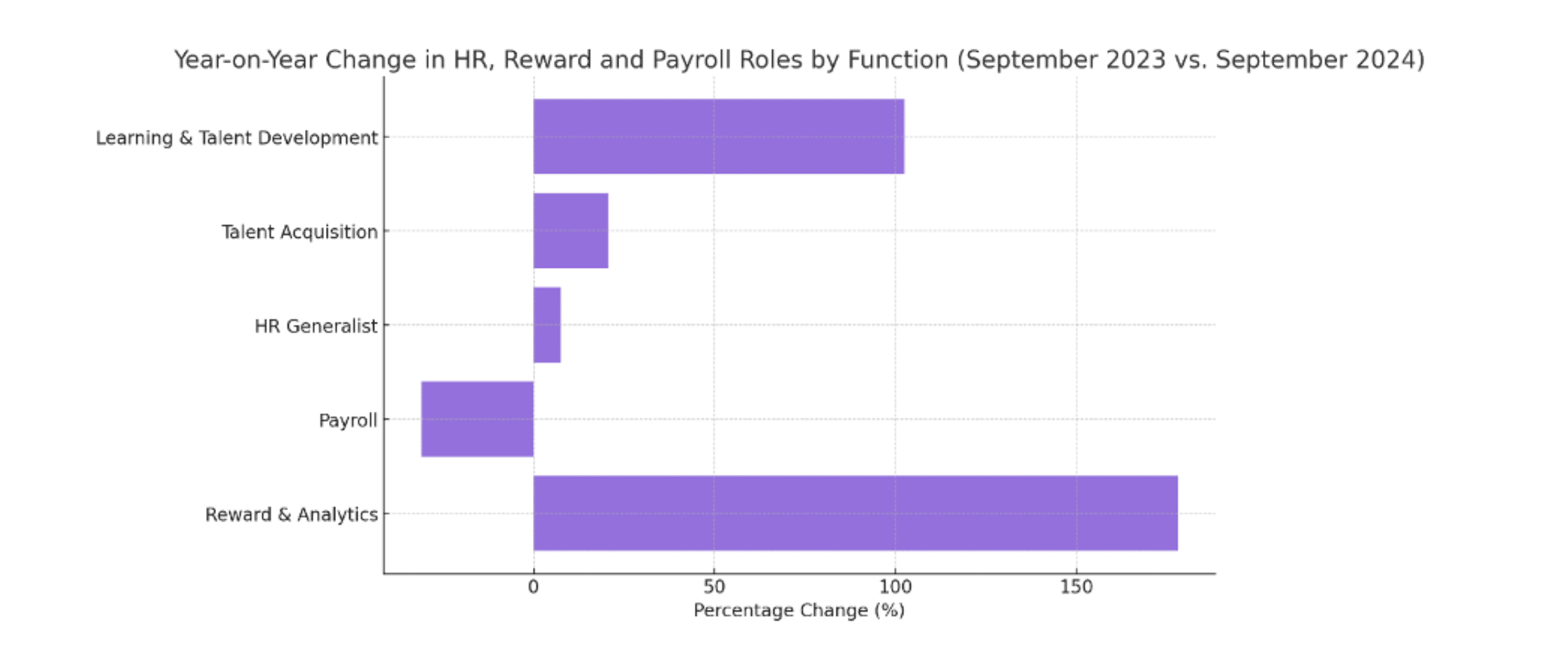

From September 2023 to September 2024, external HR jobs advertised numbers rose by 5.7%.

Comparison of job function breakdown by percentage of HR, reward and payroll numbers for September 2024 vs. September 2023:

Notable year-on-year changes by function include:

- Reward & Analytics: +178%, experienced the most substantial increase, rising by 178% to comprise 14.5% of the job market, underscoring the heightened focus on strategic compensation and analytics.

- Talent Acquisition: +20.7%, likely driven by competitive hiring needs.

- Learning & Talent Development: +102.5%, doubling to 12.1% of all HR roles in September 2024, indicating a strong focus on employee growth, as companies invest in upskilling and employee development.

- HR Generalist: +7.6%, showing sustained demand for adaptable professionals who can operate across a broad range of HR functions.

- Payroll: -31%, potentially due to consolidation or automation.

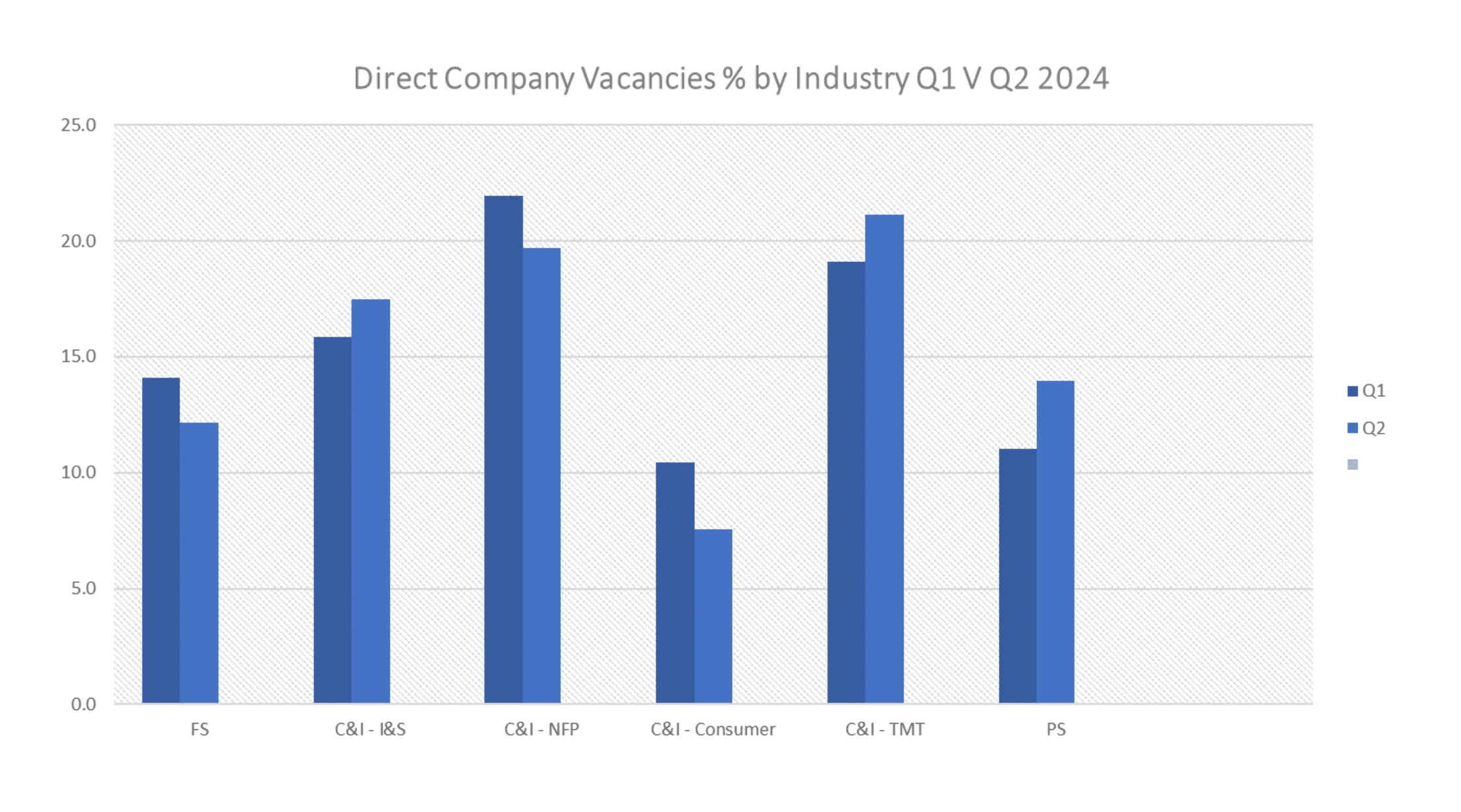

Industry Breakdown and Sector Insights

The professional services sector – including legal, accountancy, consultancy, and property sectors – led growth, with a 32% increase, now comprising 12.5% of HR roles. In a recent sector market update, Sarah Alexander, Director of Financial and Professional Services at Oakleaf, commented that this “job flow, driven by strong performance in 2023, allowed for continued investment in HR functions.”

Financial services saw a dip early in Q2 but showed signs of recovery, accounting for 13% of the market. Beth Hicks, Manager of Oakleaf’s Financial Services team, commented in a recent article on the HR Market: “Companies are rebuilding and investing more in their recruitment teams to enhance their hiring strategies and attract the best candidates.”

Industry and science roles grew by 15.2%, while the TMT (technology, media, and telecom) sector rose by 15.5%. Conversely, external consumer roles (retail, hospitality, leisure) dropped 24.2%, though demand for HR business partners and talent acquisition roles recently rebounded in these areas.

The not-for-profit sector also saw a 6.3% decline, although in her market commentary Oakleaf’s Director of Commerce & Industry, Alice Hamp, notes: “Not-for-Profit (NfP) has shown real stability, unaffected by broader economic conditions. Growth has been driven by digital transformations and steady growth strategies, particularly in charities, while luxury retail has maintained steady growth.”

A Brighter Outlook for H2 2024?

The first half of 2024 demonstrated signs of a shifting HR landscape, with strong demand for recruitment, reward and analytics professionals in particular as we move optimistically into the second half of the financial year. The industry remains dynamic, with professional services, industry, and TMT sectors driving growth, financial services showing promising signs of bouncing back while consumer and not-for-profit sectors face economic challenges while also hinting at increasing conditions to come.

As companies balance post-Budget concerns with talent needs, it will be interesting to see if the encouraging growth in demand for recruitment professionals persists and if other specialist HR roles gain renewed momentum in the latter half of the year.

“As businesses continue to face economic uncertainties, technological advances, and evolving workforce expectations, we remain dedicated to finding innovative solutions that support our clients through these changes.

Whether it’s responding to new market conditions or building the HR teams of tomorrow, we are here to ensure that our clients thrive.”